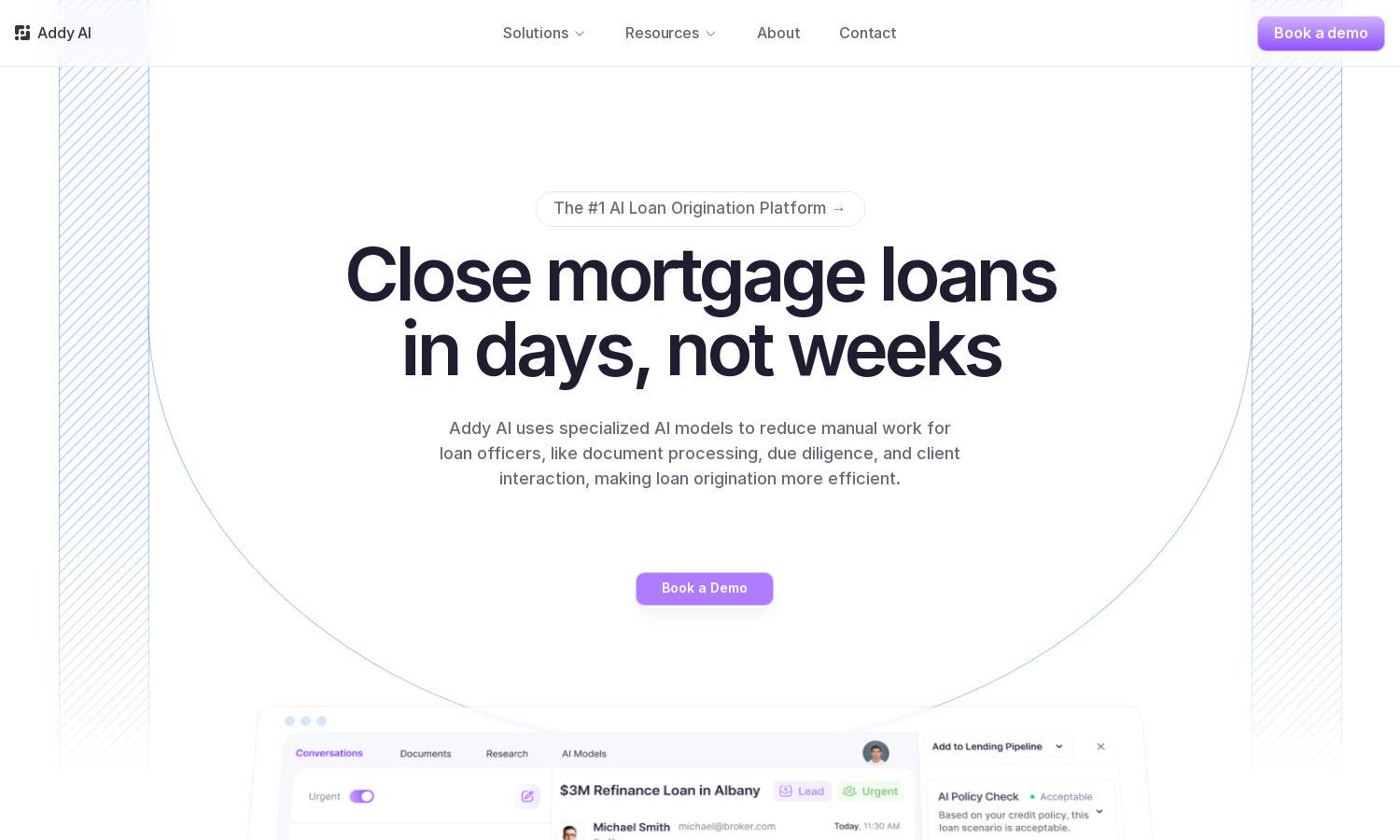

Addy AI

About Addy AI

Addy AI is designed for mortgage lenders, providing a platform to automate the loan origination process. With specialized AI models, it significantly reduces manual tasks, enhancing efficiency and client satisfaction. Users can train custom AI to handle document processing, client interactions, and follow-ups, revolutionizing their workflow.

Addy AI offers tiered pricing plans tailored for lenders. Each plan unlocks unique features, enhancing automation and efficiency for loan processing. Premium tiers provide advanced AI capabilities and priority support. Users benefit from upgrading as they gain access to specialized tools that streamline their mortgage origination workflows.

Addy AI’s user interface is designed for seamless interaction, allowing users to navigate effortlessly between features. The intuitive layout enhances the browsing experience, with clear sections for automation tools, document processing, and client management. This user-friendly design enables mortgage lenders to utilize Addy AI’s capabilities effectively.

How Addy AI works

Users start by signing up for Addy AI and onboarding their data. The platform allows quick integration with existing CRM systems, ensuring a smooth transition. Once set up, users can train their AI model to automate tasks like document analysis and client communication, thus simplifying the workflow for mortgage lending significantly.

Key Features for Addy AI

Automated Document Processing

Addy AI's automated document processing enables mortgage lenders to handle vast amounts of paperwork efficiently. By leveraging advanced AI technology, users can eliminate manual data entry, reduce errors, and accelerate loan approvals. This core feature transforms how lenders manage documentation, ultimately enhancing operational efficiency.

Custom AI Training

The custom AI training feature of Addy AI empowers mortgage lenders to personalize their automation processes. Users can develop specialized AI models tailored to their unique lending criteria and policies, ensuring higher accuracy in loan management. This capability allows lenders to enhance client experiences and streamline operations.

Instant Loan Assessments

Addy AI's instant loan assessments provide real-time evaluations based on user-defined credit policies. The platform quickly identifies borrower eligibility and suggests adjustments if necessary, facilitating faster decision-making for lenders. This feature significantly reduces the time required for loan approval processes, improving customer satisfaction.

You may also like: